Insurers Not Ready for Internet of Things (IoT) says Report

November 06, 2014

By Peter Bernstein

Senior Editor

There is no disputing that the connected world, which the tech industry for lack of a better term is calling the Internet of Things (IoT) and/or Machine-to-Machine (M2M), has arrived and is growing in importance. It also is no longer a matter of conjecture as to the impact ubiquitous connectivity to monitoring devices will have on insurers. Whether it is in the already hot area of telematics as it relates to automobile and other forms of transportation insurance, telemedicine, property insurance, etc., having a treasure trove of data for crunching by sophisticated analytics to establish more meaningful risk management capabilities is the future foundation for setting premiums and paying claims.

However, even given acknowledgement that the above is inevitable by IT professionals, even if just how fast this future is approaching and how disruptive it might be for insurers in terms of their ability to leverage the opportunities created, there is an interesting question to be asked. That question is how ready is the C-suite at insurance companies to invest in what it will take to optimize IoT. In short, are insurers ready?

The researchers at consulting firm Celent put that exact question about IoT readiness to a panel of CIOs and the panel indicated that readiness for IoT is not good. The findings contained in Celent’s report "Are Insurers Ready for the Internet of Things?" may be surprising.

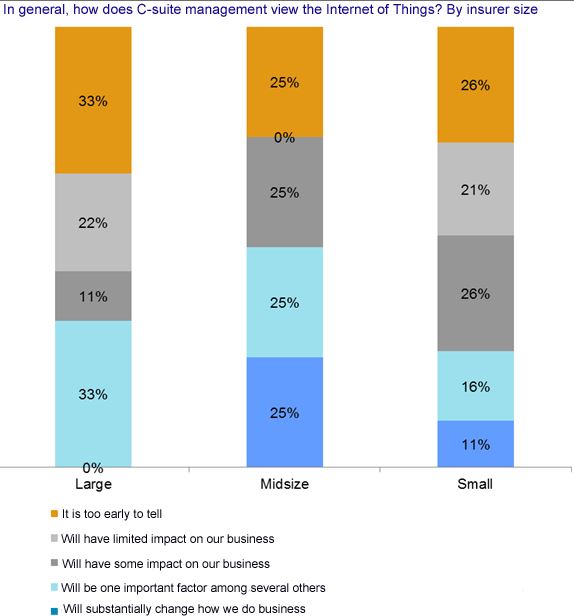

The panel consensus as seen below is that it may be years before most insurers have the tools to capture, analyze and integrate IoT into their pricing, underwriting and claims operations.

Source (News - Alert): Celent Report, Are Insurers Ready for the Internet of Things?

“In general insurers are in a watchful waiting mode. They believe that the Internet of Things will make a significant difference to how they do business,” says Donald Light, Director of Celent’s Americas Property & Casualty Practice and author of the report. “But they see this occurring over a period of several years. Auto insurance telematics / usage-based insurance is the one notable exception to that general trend.”

The report also found that large insurers, those with over $1 billion dollars in annual premium revenues seem less prepared than their medium-sized ($500 million - $1 billion) and smaller (under $500 million) competitors in terms of plans or C-level buy-in for leveraging IoT.

The message here is loud and clear for insurance company executives. They need to invest, or at a minimum have a strategic plan in place with well articulated responsibilities and metrics, now in the technology tools needed for success or suffer the consequences.

One would think based on non-tech C-levels looking at what has already happened in the auto insurance part of their business, that has disrupted and is transforming that business as a result of ubiquitous telematics, that they would be excited about and planning for the competitive advantages in all of their lines of business that IoT will have to offer.

It appears from the report that top insurance execs believe that time is on their side. After all, just taking the connected home as an example, it will take many years before most homes become smart (fire extinguishers, sophisticated security including video surveillance, room life-cycle measurements, life-style management capabilities etc. They seem to believe that it is ok to be a “fast follower” rather than a “first mover.”

History in most verticals that get disrupted, music and books are familiar examples, point to the penalties established players suffer when they don’t act in time. IoT is moving fast. For insurers who are not capable of being first-to-market, fast-in-market and have the tools to be responsive to the increasing speed of change, it should be time to rethink what success might look like even just a few years from today. IoT is a game changer no matter the product and services mix, and executive understanding and buy-in needs to be created much sooner than later.

Edited by Peter Bernstein

|

Article comments powered by

|

Internet Telephony Magazine

Click here to read latest issue

Internet Telephony Magazine

Click here to read latest issue CUSTOMER

CUSTOMER  Cloud Computing Magazine

Click here to read latest issue

Cloud Computing Magazine

Click here to read latest issue IoT EVOLUTION MAGAZINE

IoT EVOLUTION MAGAZINE